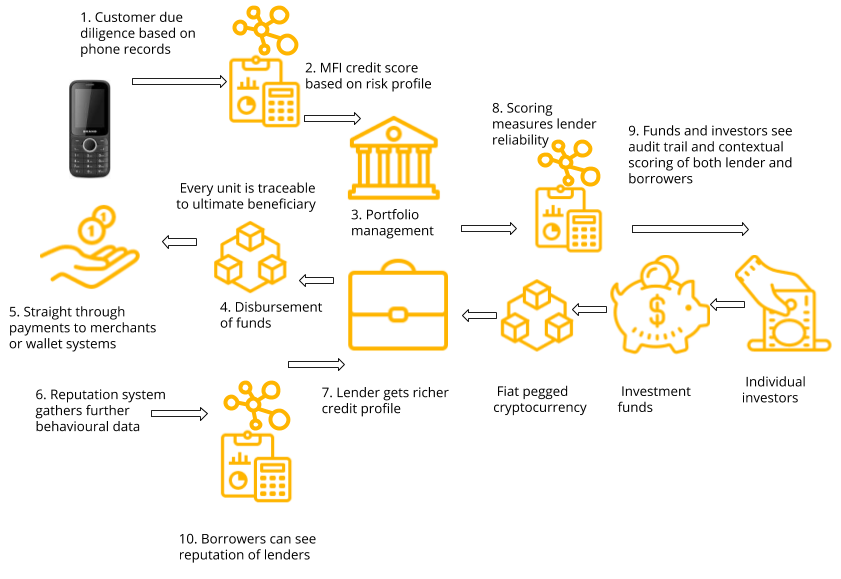

We’re working on several projects for developing economies in the background, and a theme that’s emerging is the need for automation, auditing and removing friction from microfinance solutions. With Microfinance Institutions providing loans to one of every ten people on the planet, and charging an average 40% interest, they’re both a help and a significant hindrance to unbanked people trying to break out of poverty. Our solution streamlines and automates the expensive manual KYC, disbursement and collection processes, while auditing both lenders and borrowers to enforce good behaviour.

See our whitepaper for more detail, or get in touch with the team at info@hivenetwork.online.

To browse our research, click here.