Using Digital Technology to Build Opportunities

We strongly believe in the potential of innovative technology to promote growth, enhance resilience and empower micro-entrepreneurs worldwide in achieving their goals and strengthening their livelihoods.

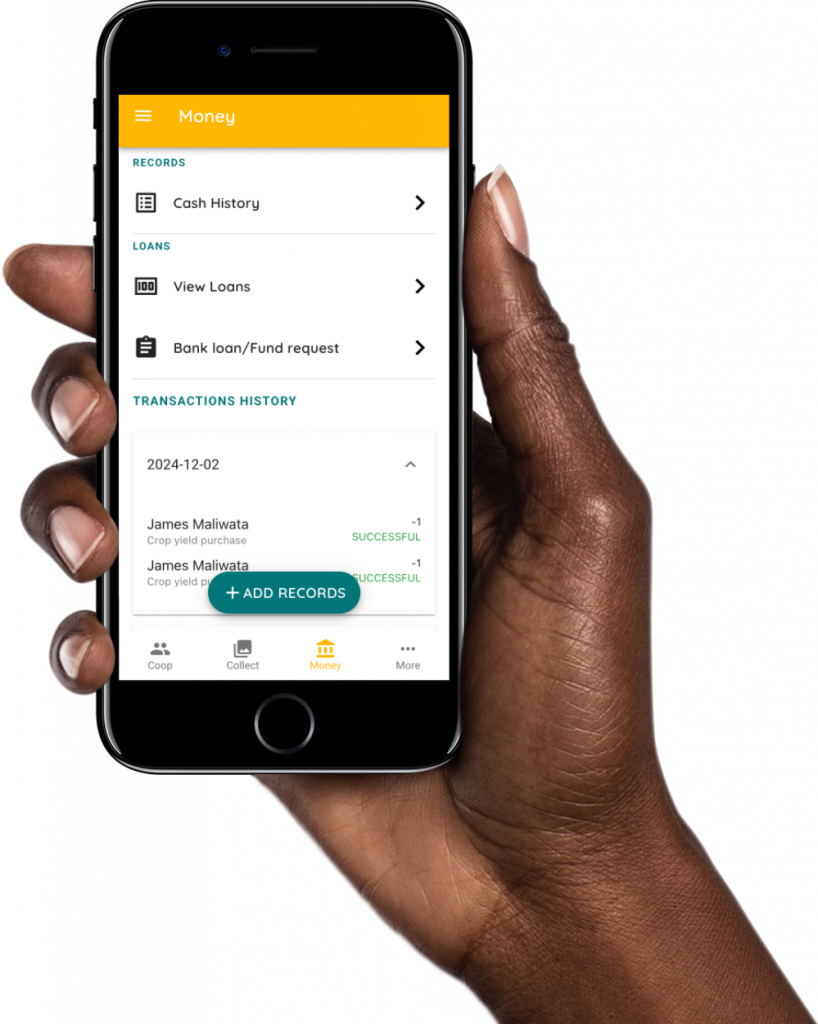

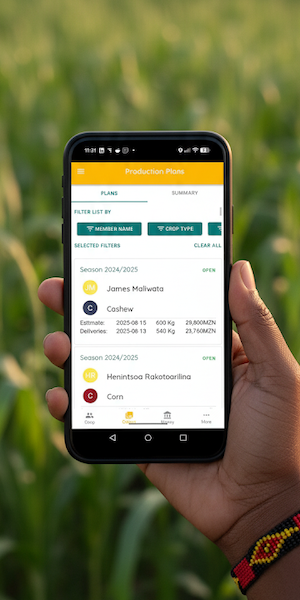

Our mobile-based digital solutions establish farmers in their wider ecosystems, leveraging savings groups, farmer organisations and agent networks and connecting them to the agricultural economy.

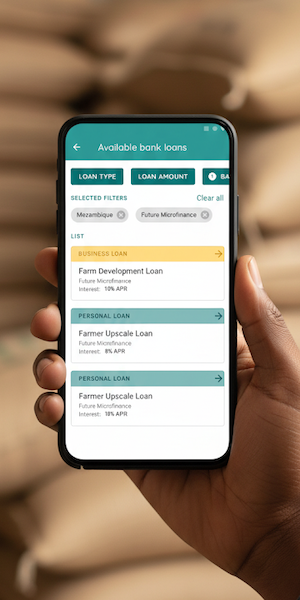

Our digital finance platform, backed by blockchain, builds trusted data and relationships, facilitating access to financial services, agricultural inputs, and market buyers.

Unlocking the Potential of the Informal Economy

Smallholder farmers across Africa are trying to build a better future but are faced with a lack of resources, growing inequality, climate change risks and weak linkages among actors within agricultural value chains.

More than 80% of sub-Saharan Africa are smallholder farmers and yet 1% of bank lending on the continent is allocated to the agricultural sector. That’s a $106 Billion funding gap.

80% of Africa’s food comes from small-scale farming. The sector plays a crucial role in feeding local populations and meeting international demand for agricultural commodities. Access to the right resources and linkages unlocks tremendous opportunities for these communities. With improved financing and agronomy, the continent could nearly triple its production of essential crops like maize, rice, and wheat on existing farmland.

Holistic Solutions for Growth

Our solutions support farmers with access to:

- quality inputs and machinery

- knowledge and advisory

- wider markets and better prices

- finance and investment

We cover the whole agricultural lifecycle to provide a growth engine that empowers the farmer at every step of the way.

Our Impact at a Glance

- 75,000+ smallholder farmers

- Working with communities in Mozambique, Kenya and Ghana

- Regulatory approval from the Central Bank of Mozambique to facilitate third-party lending and financial inclusion to communities

- Supporting the value chains for 52 crops, from inputs and knowledge to selling and finances

Select a location to learn more about our past and current projects.