Transforming Financial Inclusion in Niger

Niger is the one of the most undeveloped countries in the world, according to the UN’s Human Development Index. It’s a vast country, the largest in sub-Saharan Africa with a population density of just 14 per kms. Only 7% of people have bank accounts, and they’re nearly all men, because women are culturally restricted from many financial and commercial activities. Digital payments and mobile money have so far failed to make much of an inroad, and cash is risky because of conflicts and lack of infrastructure.

Village Savings and Loans Associations, based on informal savings behaviour adopted all over the developing world, were formalised in 1991 by CARE in Niger to help women to save money and get access to affordable small loans. The members forming these associations (usually 10–25 members) are self-selected and they contribute their own money into a fund. The money is then given to individual members as loans to grow their businesses or pay for other needs they might have. Some groups have set up social welfare funds, to provide small grants to members during emergency situations. VSLAs have had a huge impact on these groups, reducing dependency on aid and bolstering members’ resilience in times of economic shocks.

The challenge and the solution

While VSLAs have transformed women’s ability to save money and empowered them to increase earning potential, the absolute amount of capital held remains small and has not enabled the significant growth of business activities needed to make women completely financially secure. This challenge is being addressed by providing opportunities for the women to develop artisanal and business skills, on top of access to loans and other financial products. However, given the informal nature of VSLAs, it is challenging for most of these groups to access formal financial services.

CARE in Niger, in collaboration with CARE in Denmark and hiveonline, launched the “BlockSaver Project” to resolve these challenges with a digital solution they named “e-ARZIKI”(roughly translates to “digital wealth”). eArziki will enable the women in Niger’s biggest VSLA, Mata Masu Dubara (MMD) or “Women on the Move”, to access more business capital to facilitate business growth, reach wider markets and build formal commercial history so they can establish credit history and formal ownership credentials.

The digital solution is in line with CARE in Niger’s Digital Camp Program, an interpretation of what Niger envisions in its National Strategy for Sustainable Development and Inclusive Growth (SDDCI-2035). In the strategy, ICT is regarded as an important accelerator of development through the “Intelligent Villages” program that will provide e-services to rural communities in different sectors such as education, agriculture, finance, government services etc.

Niger has a growing internet and mobile technology penetration; this presents immense opportunities to the BlockSaver Project. Smartphone usage, however, is still low. A simple Android app, a common approach that most developers would use to design rich digital solutions targeted for developing markets, was not enough. For eArziki, hiveonline — CARE’s technology partner, chose to create a Progressive Web App (PWA). PWA is a cross-platform technology allows both online and offline functionalities and is supported by Android devices and KaiOS devices. The latter devices are available for a price as low as ~17 USD.

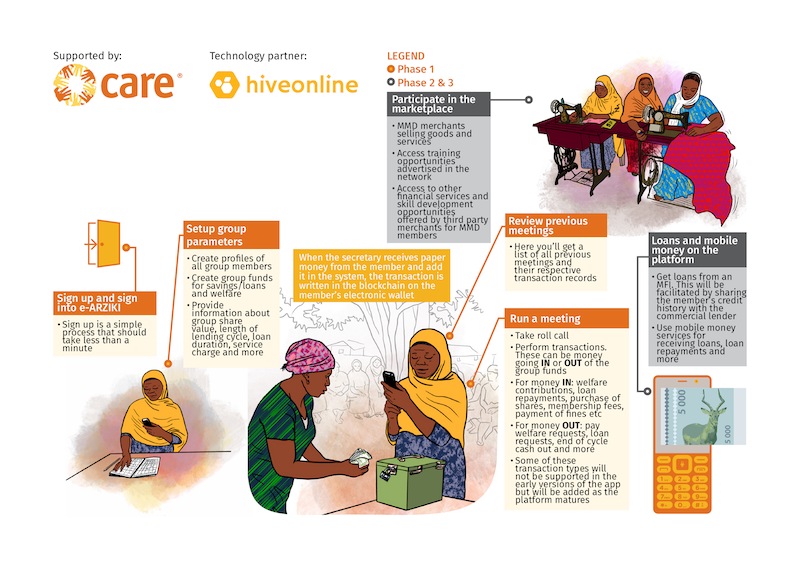

The project is being delivered in three phases — Phase 1 (Digital Ledger), Phase 2 (Value Transfer) and Phase 3 (Marketplace).

Phase 1 — Digital Ledger

In the first phase of the project, the main goal is to gauge the capacity of MMD groups to adapt to using mobile technology to replace current practices by digitising the existing paper-based ledgers. It covers typical MMD transactions and record-keeping usually done by the secretary (record keeper) on behalf of the group. Group secretaries can add members’ information and use the app to log members transactions during meetings. Generating this body of MMD data is critical first step to create a “reputation score” for each member and is an important component of other functionalities that are planned on the platform.

eArziki is powered by the Stellar blockchain. Digital records of savings, loans and other transactions by MMD members will be saved in a low latency distributed ledger. This means that there is no need for centralised authorisation or central ledger, the blockchain is the ledger and a copy of it is recorded on every node in the network. With peer to peer connections and lack of central authority, payments are more simplified as transactions are validated computationally by nodes on the network. Blockchain networks relying on mathematical proof are more suited for low-income customers as they do not need ownership of significant holding (proof of stake) or the famous electricity-hungry proof of work used by public blockchains like Bitcoin.

With eArziki, MMD secretaries can automate challenging tasks with precision and reduce errors in the records. Such tasks include end of saving cycle cash-out, loan calculations, mid cycle cash out etc that can involve cumbersome mathematics. They can reduce the risk of losing historical ledger data when paper records are damaged or lost and easily review and share member records.

Phase 2 — Value Transfer

In this phase, the focus will be on integration with microfinance institutions and telecommunications operators. It will enable availability of affordable loans to meet higher capital needs by MMD members, access to microinsurance services, opportunity to open savings accounts and access other MFI services. It reduces the cost and risk of lending for microfinance institutions too, giving them visibility of the groups’ and women’s track records, while taking away the risk of moving cash. Integration with mobile payment services will allow MMD members to receive their loans and make repayments without needing to travel to an MFI office and in situations where they cannot attend group meetings. Other planned functionalities include feature phone support for select functionalities as smartphone and smart-feature phone penetration is still low. Additionally, to broaden the reach of available services on the platform, enhancement will be made to support more service providers in the marketplace.

Phase 3 — Marketplace

For the final phase, the focus will be on acquiring and engaging merchants to support a vibrant marketplace coupled with integration of MMD networks on the platform to allow more interconnectedness among them. These functionalities will provide opportunities for MMD women to trade their goods and services on the platform, get services from merchants outside the MMD community, get loans from other groups that are doing much better within their network and much more. Critically, they will see the full value chain of the sale of goods, so even where they are restricted to villages, they can ensure middle men are honest and that they’re getting a fair price for their goods.

eArziki launches on 10 July in Niger, at the i4dev technology fair. You can read more about the project and hiveonline’s community finance agenda on our community finance page.

The project demonstrates the transformational potential of blockchain based technology for the lowest income groups. For technology providers like us, it’s an exciting path to push the boundaries of what’s possible with blockchain solutions; for CARE it’s an opportunity to benefit many more women; for the lender it’s a market opportunity. But for the women, it’s the empowerment to grow their businesses, build stronger and more sustainable communities, and create a better future for everyone they support.

UPDATE: hiveonline stopped working on the CARE eArziki project in March 2020 after mutual agreement to end the partnership. While the savings group application was developed and tested, it did not go live and was not used by groups in Niger.